Impact on Small Business of the Tax Cuts and Jobs Act

The new tax law has many complexities. At first glance, the small business components may seem easy to understand, but they get muddled quickly with the addition of numbers and details. Let’s start with the simple 20% reduction of pass-through business income.

The scope of this article is limited to small businesses. Feel free to read our take on the individual components.

The 20% Pass-Through Deduction: Complications and Limitations

The additional 20% deduction on self-employed or pass-through income seems like a potential windfall, like the reduction of the corporate rate from 35% to 21%; but it is limited for someone who operates a business, like a professional service firm or a consultant. It’s still an extra deduction for many, but it might not be as favorable as if the business was a scalable business that has income from products or apps instead of its people. Even with limitations, it’s still an additional deduction for many small business owners. To illustrate how the limitations work, let’s jump into some examples:

Suppose Sarah owns a small business and is in the 24% tax bracket. Her business has profit equal to 50,000. The 20% deduction would give her a $10,000 deduction, or a tax break of $2,400. On the face, this seems like a great extra deduction, but before making a conclusion, we should consider the anti-abuse rules.

Suppose Sarah’s business is a side-business, and she makes $160,000 in addition to her business income, putting her in the 32% bracket. She will lose her $10,000 deduction. The 20% decreases by 1% for each $2,500 she makes over $157,500.

If Sarah is paying herself salary out of the business, her salary will not qualify for the 20% deduction. In this way, the 20% deduction benefits mostly lower-income taxpayers or taxpayers who own a business that profits for reasons besides the owner’s professional service skill.

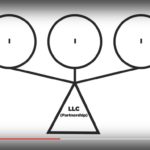

Corporations

With a reduction of the corporate rate from 35% to 21%, everyone will want to look at corporations. Luckily for us we have a lot of experience changing businesses from one entity to another.

Owning a C corporation is a lot different than owning a flow-through business. It requires a higher level of organization.

Of course, requiring a regimented business isn’t the only cost. Business income will now be subject to double taxation, meaning that income will be taxed at the corporate level and then taxed again as capital gains when it the money is distributed to you. This may make C corporations less favorable than anticipated.

Suppose Benjamin’s business makes $1,000,000 in profits. The corporation pays a 21% tax. It now has $790,000 to pay to Benjamin. When it pays him, he’ll have a 20% capital gains tax rate on the money. This means he is left with $632,000, or there’s a total tax of 36.8% on it, just a touch below the maximum individual rate of 37%.

It might be advantageous to control the timing of the income on the individual tax return, but then the business might be subject to the Accumulated Earnings Tax.

Complicated

Luckily, we specialize in unique solutions for businesses. There is an optimal balance, and we find it for each of our clients. When you aren’t sure what you should do about your business’s entity structure, set up a coffee meeting with one of our professionals.

Justin Sundberg is the Managing Member of Sundberg Tax & Consulting, a high-frequency accounting firm in the Twin Cities that specializes in unique, outside-the-box solutions for innovative companies and complex individuals.

Want to learn more? Say hi at hello@sundbergtc.com, text us at (651) 689-4789, or check out our website at www.sundbergtc.com.